This protection will certainly provide satisfaction if you borrow a vehicle from a good friend or relative. It additionally covers incidents that happen in a rental vehicle. Cash, Nerd reports that non-owner SR-22 insurance policy costs an average of $387 each year in Iowa - insurance coverage. The firm located the least expensive plans from GEICO at $259 every year and State Ranch with an ordinary cost of $162 per year.

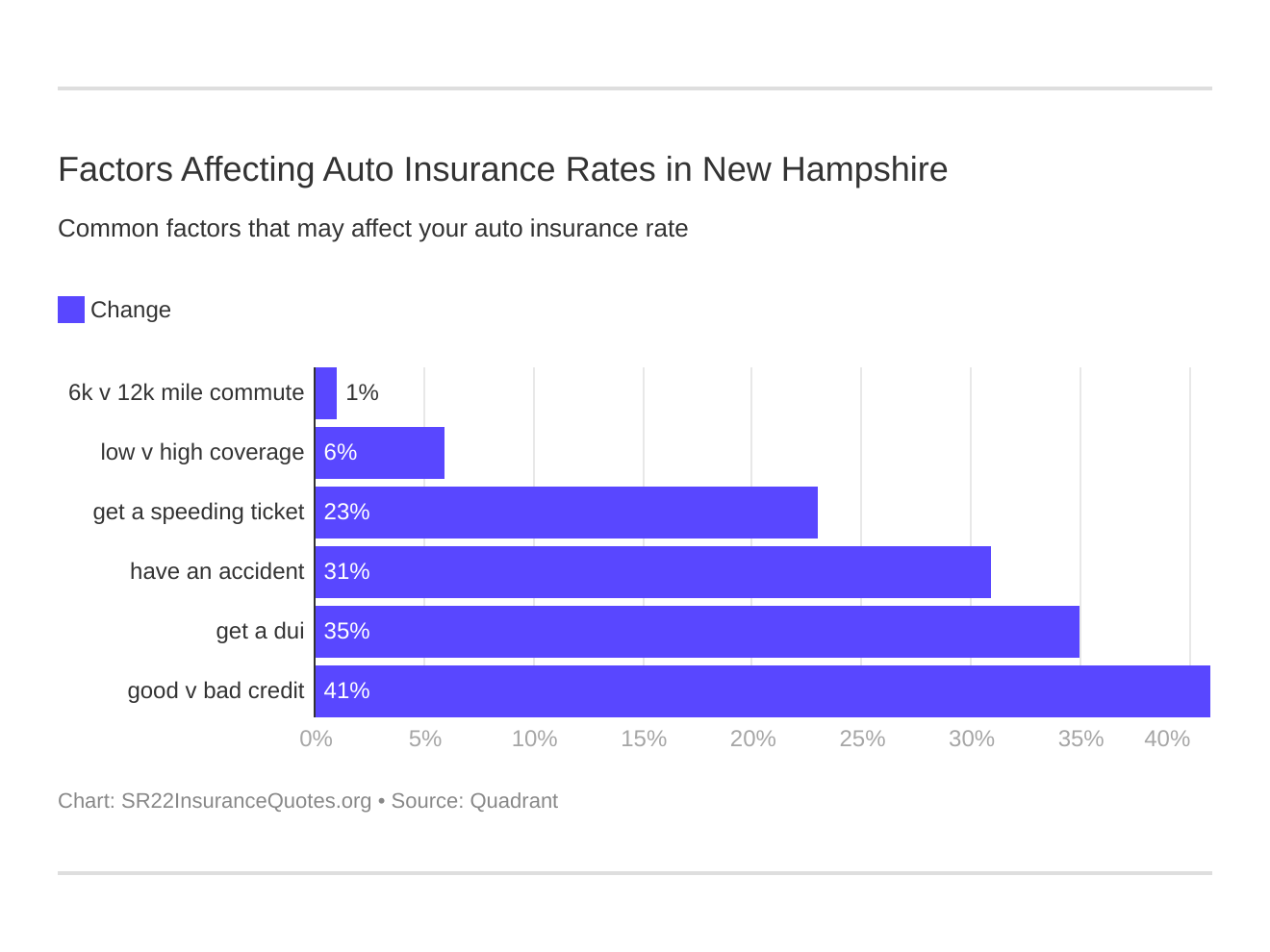

Insurance policy providers likewise take into consideration: Due to the fact that younger and a lot more unskilled motorists have a higher analytical price of accidents, auto insurer bill more to offset this greater threat - driver's license. Motorists generally start to see costs drop around age 25. department of motor vehicles. Auto insurer associate a high risk of insurance claims with a lower-than-average credit history.

If you want full coverage instead than minimum insurance, greater insurance coverage limitations, or various other attachments, you will pay more for those alternatives. Exactly How Can You Conserve Cash on Iowa Insurance?

If your SR22 car insurance plan is cancelled, lapses or ends, your car insurance provider is needed to alert the authorities in your state. (They do this by issuing an SR26 form, which licenses the cancellation of the policy. bureau of motor vehicles.) At that factor, your certificate can be put on hold again or the state may take various other serious actions that will certainly limit your capability to drive - liability insurance.

Failure to maintain your insurance policy coverage might create you to shed your driving privileges once again and your state might take other activities versus you. It's ideal to keep the SR22 for the whole mandated period of time. State regulations pertaining to SR22 auto insurance coverage demands can be complicated. That's why it's so vital to get trustworthy information and assistance from qualified insurance representatives at respectable SR22 insurance provider.

And also, experienced agents will certainly be able to assist you locate an approved economical SR22 insurance plan. If you have much more concerns regarding SR22 insurance policy or any type of other service or products, come by a Straight Automobile Insurance location near you or call a representative at 1-877-GO-DIRECT (1-877-463-4732). At Direct Automobile, you can obtain the inexpensive vehicle insurance protection you need, the solutions you desire, as well as the regard you deserveregardless of your insurance background. driver's license.

The Only Guide to How Much Does Sr22 Insurance Cost A Month - Biztoolspro.net

You are mosting likely to be really satisfied. It is always excellent to know that SR22 is not like regular auto insurance. That is a certification for Department of Motor Autos that you have the ability to bring routine vehicle insurance for your car. Because of this not every auto insurer is able to help you with SR22 - vehicle insurance.

We see to it that all plans are effectively filed and preserved. The most typical factor for SR22 insurance coverage in California is to renew driver's certificate. Nowadays a cars and truck is a part of our lives. Life can come to be a headache without having lawful capability to drive. Here is a total listing of reasons for SR22 need in California: DUI (Driving under the impact of alcohol) DWI (Driving while intoxicated) Caught on driving without automobile insurance. coverage.

In California SR22 insurance is mandated for 3 year duration. For DUI instances it can be required for 5 years. It is mandatory to preserve it for the whole term of demand without any quits. In case you stop working to keep your plan you will be needed to start over.

You are probably to obtain this requirement for several offenses. Because of this, the last cost will be readjusted according to your driving background. For example: DUIs, accidents, claims, etc. Your age young chauffeurs under age of 25 have higher prices for insurance policy costs. Motorists at the age of 55+ will have reasonably reduced prices - credit score.

They are a lot more accountable than those who are presently solitary. Simply put, wed individual will most likely obtain far better prices then unmarried with same profile. insurance group. Sex based upon criminal statistics across the United States, men are more probable to go against web traffic laws - ignition interlock. That is why males will have a little higher prices on insurance policy.

Higher performance automobiles are additionally extra pricey on repairs and service. Stats are also showing that there is greater possibility of crash when driving cars. Credit rating poor history with financial institutions can result in higher insurance coverage rates. SR22 is all concerning the ability to keep your insurance policy condition throughout required duration.

Get Cheap Sr22 Car Insurance - Cheapinsurance.com Can Be Fun For Anyone

However, Select Insurance Team is capable to supply prices even less then $15/month. This is because of the reality that we shop several resources to supply cost effective rates to our clients. Pretty usually we have discount rate programs. The most effective way to inspect if you are qualified is to fill out our quote kind - bureau of motor vehicles.

As soon as accepted you will get a letter from the DMV stating they have received your auto insurance with type SR22. Maintain this insurance for a minimum of 3 years or your court-ordered suspension duration. insurance. Do not let this policy gap as your license will certainly be put on hold again and also the period will begin again - auto insurance.