Non-owner insurance policy just uses if you do not have accessibility to an automobile within your family. For example, if your roomie has an auto, a non-owner plan might not be readily available. Instead, you could require to be listed on your roommate's car insurance policy, and their insurance provider would certainly issue the SR-22 for you.

When you acquire a car, you would then transform your insurance coverage to a conventional automobile insurance plan. Your car insurance coverage will certainly be extra pricey if you have to have SR-22 insurance in California.

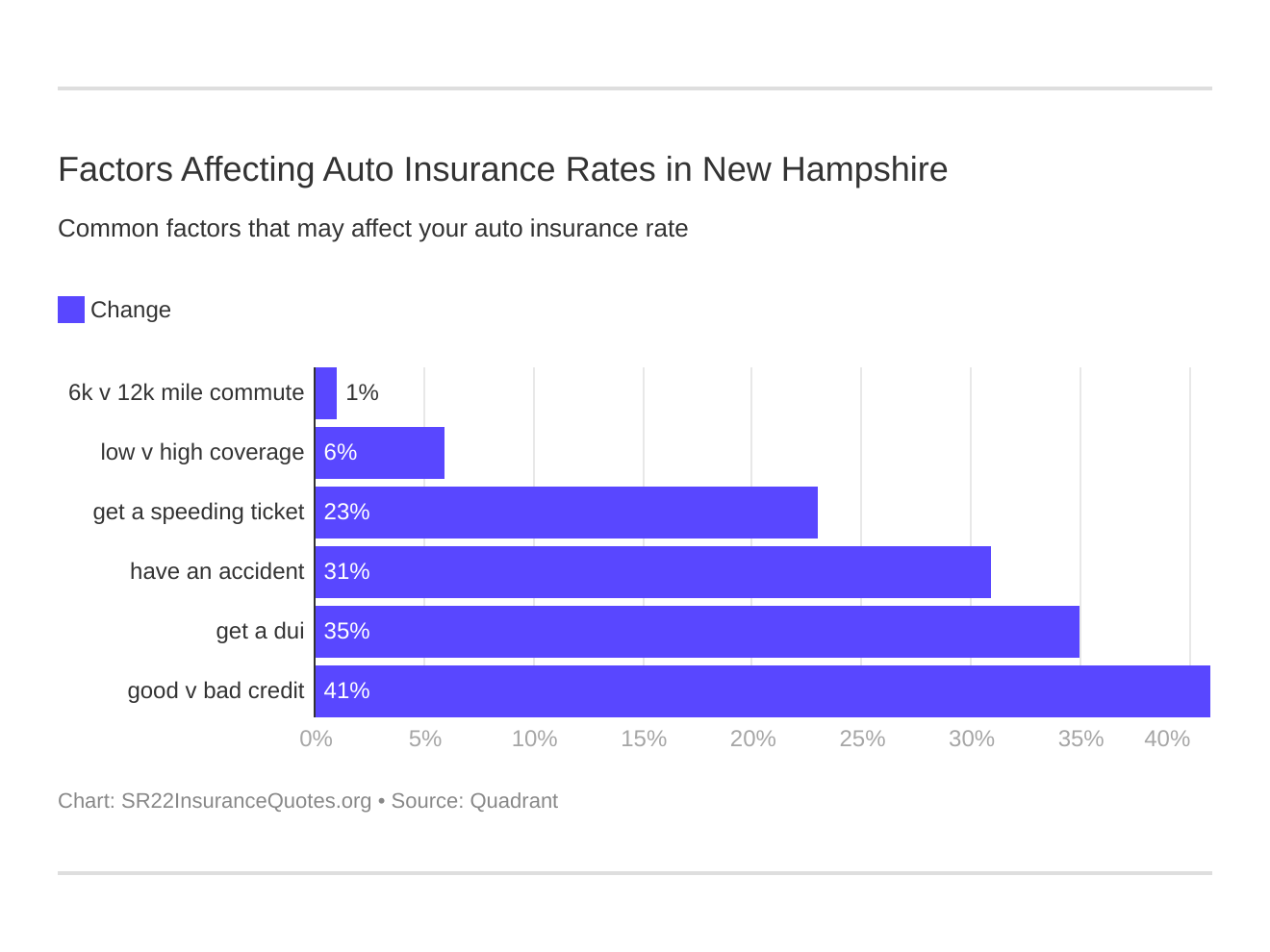

Most insurance provider keep the surcharge on your policy for three years (sr22 coverage). Once you hit the three-year mark, the additional charge will certainly "drop off" and not be charged for anymore at the next insurance renewal. This causes a decrease in your insurance rates as long as you do not have various other tickets or task added.

Talk to your insurance provider concerning exactly how these costs are handled so that you know what to anticipate. It's no key that a person with lots of tickets or accidents is a much more dangerous driver than a person without that task. department of motor vehicles.

That triggers all of your insurance policy prices to be higher, also without the direct additional charge that comes from the activity itself. Your risk classification usually lasts five years, yet a DUI can influence your threat for 10 years - insure. That's why SR-22 insurance coverage can be more pricey long after the SR-22 is no longer called for and the drunk driving has diminished the direct surcharge list - ignition interlock.

Get This Report about Velocity Aircraft Company. Global Piston Engine Aircraft Market ...

When it drops off, you can take back the class to renew the bargain (vehicle insurance). Lots of insurance providers give a lot more than simply car insurance coverage, such as home owners and renters insurance coverage (credit score). When you lug both your car and home plans with one company, you might get approved for a multi-policy price cut that reduces the premium on both sorts of insurance.

A lot of insurance providers use a multi-car discount rate if you have more than one vehicle with them. Having numerous vehicles on one policy is normally cheaper than having an individual policy on every one, so be sure to ask for a quote. liability insurance. Insurance firms constantly desire you to have ideal insurance policy protection, but sometimes transforming the sorts of insurance coverage on your cars and truck can make a large difference.

If you intend to continue with thorough as well as accident insurance coverage, why not see how much you can save with a greater deductible? Usually changing the insurance deductible can save you a great deal of money every month - bureau of motor vehicles. A more secure cars and truck is less costly to insure, so make certain you allow your insurance company understand about all the security tools you have actually installed (insurance group).

If you're a excellent trainee or have one in your home that can decrease your insurance policy premium. no-fault insurance. Can being a member of the army, a professional, or holding specific subscriptions. See to it you speak with your insurance company regarding all of your associations so they can apply all the discount rates you should have.

Having a DUI or significant driving sentence is frustrating, as well as getting back on the road is a long procedure (sr22 insurance). Nonetheless, we're here to assist. We don't evaluate any individual since of their history; we intend to aid you obtain the insurance coverage you need so you can return to driving safely.

A Biased View of Best Cheap Sr-22 Insurance Rates In California

Texas SR22 Insurance Policy Questions as well as Responses The state of Texas needs an SR22 filing if you have been driving without insurance policy or other infractions such as driving under the impact of alcohol. What if I Don't Own an Automobile, Can I Still Obtain an SR22?

What's the FASTEST Means to Get Your Texas Certificate Reinstated? I Let My SR22 Insurance Coverage Lapse. What Now? If you have terminated your car insurance plan with the SR-22 develop the state will certainly be informed right away by the insurance firm - sr22 insurance. Your driver's license may be put on hold once again as well as the suspension duration might begin again once more.

Texas SR22 Insurance Policy Requirements When you submit SR22 insurance in Texas the state needs that the minimal obligation restrictions be in pressure on the plan for two years (sr-22 insurance). The minimal responsibility insurance policy limitations are: $30k Each Bodily Injury $60k Per Crash Bodily Injury $25k Home Damage While these limits are minimum they are hardly ever advised levels of coverage - dui.

02 or higher CDL chauffeurs = BAC. bureau of motor vehicles. 04 or greater All vehicle drivers = BAC. 08 or greater The fine for your very first driving under the influence crime in Texas is $2,000 as well as a required 72 hours jail time. Your chauffeurs permit will be suspended for a minimum of 90 days but no even more than 1 year.